Best Payroll Books of 2026

* We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation.

Payroll books are essential tools for any business, big or small. These books help keep track of employee hours, wages, and taxes. They come in a variety of formats, including weekly, bi-weekly, and monthly, and can be customized to fit specific business needs. Payroll books are also useful for record-keeping purposes, as they provide a clear and concise record of all payroll transactions. They allow businesses to accurately calculate employee wages and ensure compliance with labor laws and regulations. Overall, payroll books are a must-have for any business looking to streamline their payroll process and maintain accurate records.

At a Glance: Our Top Picks

Top 10 Payroll Books

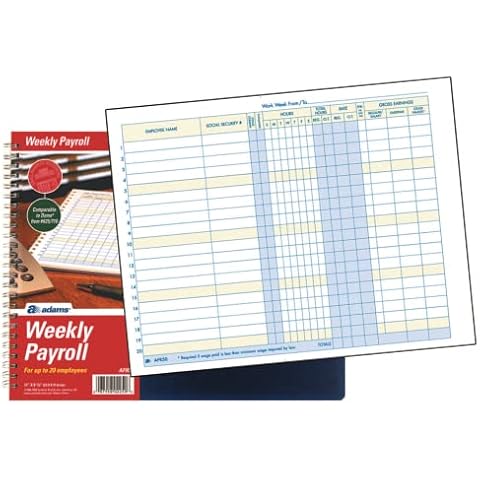

Adams Weekly Payroll Record, Spiral Binding, 20 Employee Capacity

The Adams Weekly Payroll Record is a spiral-bound book designed to help you keep track of your employees' weekly hours, pay rates, taxes, and other deductions. Its wire-o binding allows the book to lay flat so rows line up across the pages, while the blue and yellow printing reduces eye strain. The book has a summary page in the back, and it can accommodate up to 20 employees.

Dome 650 Payroll Record Book

The Dome 650 Payroll Record Book simplifies payroll record keeping with its single entry system and seven columns for deductions. It includes quarterly and yearly summaries, a calendar of tax form due dates, and an explanation of payroll tax forms. As a payroll book, it is an essential tool for small business owners to keep track of their employees' payroll records.

Dome 650 Payroll Record for 1-50 Employees

The Dome 650 Payroll Record is a wirebound book designed to help you keep track of weekly payrolls for up to 50 employees. It has seven deduction columns and includes a calendar of tax form due dates, a schedule of payroll deposits, and an explanation of payroll tax forms. Additionally, it provides monthly, quarterly, and yearly summaries to help you keep your records organized.

321Done 3.4x5.5 2-Part Carbonless Receipt Book

The 321Done Carbonless Receipt Book is designed for small business owners who need a reliable way to keep track of transactions. Made with high-quality paper in the USA, this receipt book offers durability and clear printing for your records. The pages are thicker than typical carbon copy books, which means your receipts will be easier to write on and more professional-looking. Its compact handheld size, with 50 sets of white and yellow pages, makes it convenient to carry and use on the go. Plus, the spiral binding allows you to easily flip through your receipts while the sturdy cover keeps them protected from damage.

Adams D4743 Employee Payroll Record Book

The Adams Payroll Record Book is designed to help you keep clear and accurate records of your employees' pay. It lets you easily track hours worked, gross earnings, deductions, and net pay, making payroll management straightforward. The two-part carbonless forms create duplicate copies in white and canary, so both you and your employees have neat, legible records. The wrap-around cover helps keep each set organized and prevents forms from getting messy. Plus, the consecutively numbered pages make it simple to find and reference specific records quickly. This book is a convenient tool for managing payroll with ease and clarity.

NEBS 5Forms 150NJ Payroll Cash Disbursement Journal

The NEBS Payroll Disbursement Journal is designed to work seamlessly with several check and ledger types, including 150CC, 150CT, 150NC checks, and the 150NL ledger. This compatibility makes it easy for you to keep all your payroll records organized in one place. It features 39 columns dedicated to general disbursements, allowing you to track multiple transactions clearly and efficiently. Printed on both sides of durable 20-pound white paper with blue ink, this journal offers a professional look and long-lasting use. If you want a reliable and convenient way to manage your payroll cash disbursements, this journal is a solid choice.

EGP Payroll/General Expense Journal Sheets

The EGP Payroll Journal Sheets come with 15 sheets, providing you with ample space to manage your payroll and general expenses effectively. Measuring 25 3/8 x 11 inches, these sheets are large enough for easy writing and organization. They are compatible with check model 131011, making it convenient for you to record transactions seamlessly. Additionally, these sheets work well with folding board model 101000, enhancing your overall productivity by allowing you to keep everything neatly organized. This combination of features ensures that you can handle your payroll tasks with efficiency and ease.

EGPChecks General Expense Payroll Folding Board

The EGPChecks Payroll Folding Board is designed to streamline your payroll and expense tracking tasks. It works seamlessly with One Write General Expense and Payroll systems, making it easier for you to organize your financial documents. The board measures 11 by 12.5 inches when closed, offering a compact workspace that expands to nearly 21 by 12.5 inches when open, giving you plenty of room to work comfortably. Its blue folding design helps keep your journals and checks in place with pegs, while a snap closure secures everything neatly when not in use. This setup helps you stay organized and efficient during your payroll processing.

Roll Maven Auto Repair Estimate Book 10 Pack

The Roll Maven Estimate Book is designed to help you easily create and manage auto repair estimates and invoices. Each form includes all the necessary details so you can quickly provide accurate repair costs to your customers. The two-part carbonless design means you get a clean copy for your records and a duplicate for your client, without needing messy carbon paper. Sized at 8.38 by 11 inches, the forms are large enough to write all the important information clearly. With 50 sets in each book, you’ll have plenty of forms to use for your repair jobs.

Compuchecks Business Voucher Laser Checks 500 Sheets

The Compuchecks Laser Voucher Checks come in a large pack of 500 blank checks and pay stubs, sized to fit standard printers, making it easy for you to handle payroll and banking tasks efficiently. These check papers include strong anti-fraud features like micro-printing, security screens, and watermarks that help protect your business from counterfeit attempts. You’ll find these checks compatible with popular accounting software such as QuickBooks and Quicken, so printing your checks is straightforward and hassle-free. Plus, they work well with most laser and inkjet printers, ensuring clear, error-free prints every time you use them.

Frequently Asked Questions (FAQs)

1. What are the basics of payroll?

Payroll involves tracking employee hours, calculating pay, and distributing payments. It also includes accounting, record-keeping, and allocating funds for taxes like Medicare, Social Security, and unemployment.

2. How to do payroll for dummies?

To do payroll, you need to establish an employer identification number, collect employee tax information, choose a payroll schedule, calculate gross pay, determine deductions, calculate net pay, and pay your employees.

3. How to do payroll accounting?

For payroll accounting, you need to apply for a federal employer identification number (EIN), research federal, state, and local requirements, set up pay periods, have employees fill out tax forms, total hours worked, calculate gross pay, and withhold income taxes.

4. How do you prepare payroll?

To prepare payroll, gather time card information, compute gross pay, calculate payroll taxes, determine deductions, calculate net pay, approve payroll, pay employees, and distribute pay stubs.

5. Is payroll easy to learn?

Learning how to do payroll can be challenging. Mistakes can impact your employees and may result in penalties from the IRS. It is important to have a good understanding of payroll processes and regulations.

6. What are the essential components of payroll?

The six essential components of payroll include salary, individual income tax (federal and regional), employer's and employee's social security contributions, payroll tax, and benefits. These components need to be considered when calculating and managing payroll.

7. Can you do payroll on Excel?

Yes, payroll can be done using Excel. You can enter employee and employer data into an Excel template and use it to calculate employee payments. Each month has a separate tab for payroll calculations.

During our payroll book research, we found 24 payroll book products and shortlisted 10 quality products. We collected and analyzed 10,426 customer reviews through our big data system to write the payroll books list. We found that most customers choose payroll books with an average price of $29.13.

The payroll books are available for purchase. We have researched hundreds of brands and picked the top brands of payroll books, including Adams, DomeSkin, 321Done, NEBS, EGPChecks. The seller of top 1 product has received honest feedback from 739 consumers with an average rating of 4.9.

Rebecca Cantu grew up in a family-owned retail store for home and kitchen products. She worked online and gave assistance to people to buy ideal products for their sweet home after graduating from Northwestern University with a marketing degree. She has been writing content for online shopping guides since 2011 with her professional knowledge and natural sensitivity of appliances.