Best Estate Planning Laws for Wills Books of 2026

* We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation.

Estate planning laws can be complex and confusing, which is why it's important to have a comprehensive guide to help navigate the process. Wills Books offers a range of resources to assist with estate planning, including books that cover the ins and outs of wills and trusts. These guides provide clear explanations of legal terminology and procedures, and offer practical advice on how to create an effective estate plan. Whether you're just starting to think about estate planning or need to update an existing plan, Wills Books can help you make informed decisions and ensure your assets are protected for the future.

At a Glance: Our Top Picks

9.6

9.6

Top 10 Estate Planning Laws for Wills Books

Quicken Willmaker & Trust 2023: Book & Online Software Kit

Quicken Willmaker & Trust 2023 is an excellent resource for creating an estate plan without the need for a lawyer. The software makes it easy to create legal documents such as a will, trust, health care directive, power of attorney, and many others. The step-by-step interviews guide users through the process, and the program is regularly reviewed by expert attorneys. Additionally, the 2023 edition includes important legal and technical improvements, and automatic updates keep the program current. The bonus e-book on Special Needs Trusts is a valuable addition to the package. Overall, Quicken Willmaker & Trust 2023 is a must-have for anyone interested in retirement planning and estate management.

Get It Together: Organize Your Records So Your Family Won't Have To

Get It Together is an essential guide for anyone looking to organize their important documents and records. The book provides a comprehensive framework to help readers keep track of everything from bank accounts and insurance policies to estate planning documents and funeral arrangements. The workbook is straightforward, with step-by-step instructions and helpful resources to guide completion of each section. The purchase includes downloadable forms to make the planner, which can be saved on the computer, completed, printed, and assembled to create a personal planner. Overall, this book is a must-read for anyone looking to get their affairs in order.

My Family Estate Legal Document Kit (includes Last Will and Testament, Health Care Proxy, and Legal Power of Attorney)

This legal document kit by PETER PAUPER PRESS is a great resource for families to prepare essential legal documents. With clear instructions, easy fill-in worksheets, and a glossary of terms, the kit helps users create a Last Will and Testament, Health Care Proxy, and Legal Power of Attorney. The 80-page kit is designed to take the mystery out of creating these basic documents and save users time and money on legal fees. However, it is important to note that this product is not a legal document and does not replace a valid will, health care proxy, or power of attorney. Overall, this is a helpful and informative resource for families.

My Final Wishes Planner: Everything You Need to Know When I'm Gone | End of Life Planner, Checklist & Organizer | A Detailed Information About My Accounts, Belongings & Wishes

The My Final Wishes Planner is an excellent tool for anyone who wants to plan their end-of-life wishes. The planner covers everything from personal information to funeral plans, important documents, financial details, digital accounts, arrangements for children and pets, and more. It is a comprehensive guide that can help ease the burden on loved ones after one's passing. The planner is large in size and has a soft matte cover finish. Overall, this book is a must-have for anyone who wants to ensure that their final wishes are carried out in the way they want.

The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and Taxes

The Complete Book of Wills, Estates & Trusts (4th Edition) is a comprehensive guide for protecting an estate for loved ones. Attorneys Alexander A. Bove, Jr., and Melissa Langa provide honest, clear, and entertaining explanations of complex legal topics, including creating a will and living trust, using trusts to save taxes, contesting a will, and settling an estate. The book is updated to cover the latest changes in estate law, and the authors share easy-to-understand legal definitions and savvy advice, all illustrated with entertaining examples and actual cases. The humorous and straightforward style makes it an enjoyable read. This is a must-have legal guide for anyone looking to protect their assets and ensure their money and holdings remain in the family.

Living Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)

Living Trusts for Everyone is a must-read for anyone looking to plan an estate for themselves or their elderly parents. Ronald Farrington Sharp provides clear and concise instructions on how to set up a living trust, eliminating the need for expensive lawyers and probate services. The updated second edition includes new information on handling online assets, keeping trustees honest, and strategies for lowering attorneys' fees. With easy-to-follow instructions and sample form letters, this book takes the mystery out of estate planning. Overall, Living Trusts for Everyone is an informative and practical guide that can save readers both money and headaches.

Your Level Up Guide to Asset Protection, Trusts and Estate Planning: Avoid Probate, Stop Creditors, Protect Assets, Medicaid Spend-Down

The "Your Level Up Guide to Asset Protection, Trusts and Estate Planning" is a comprehensive guide that demystifies the complex world of estate planning. The author's goal is to educate everyone on the benefits of estate planning and how to best use tools such as wills, trusts, LLCs, powers of attorney, and probate to protect, preserve, and transfer assets. The book is a valuable resource for anyone who wants to avoid probate, stop creditors, protect assets, and navigate Medicaid spend-down. The author's approachable writing style and clear explanations make this book a must-read for anyone looking to level the playing field and bring peace of mind to their estate planning.

Make Your Own Living Trust

Make Your Own Living Trust is an excellent do-it-yourself manual for creating a valid living trust in your state, without the need for a lawyer. It provides all the necessary instructions, worksheets, and forms to create an individual or shared living trust and a basic will for yourself and your family. The book helps you to decide whether a living trust is right for your family, appoint someone to manage trust property, and name beneficiaries to inherit your assets. This book is an excellent resource for anyone who wants to learn about living trusts or create one on their own.

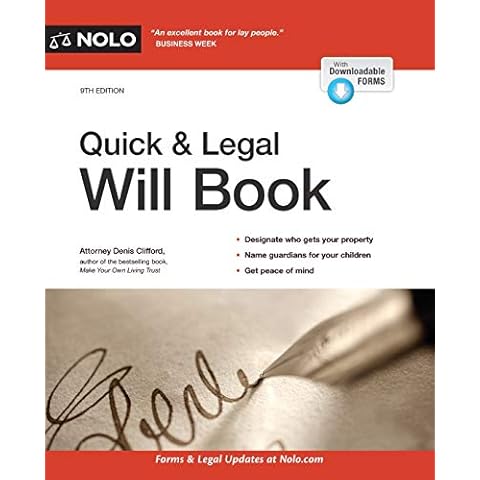

Quick & Legal Will Book

The Quick & Legal Will Book by NOLO is an excellent guide for creating a simple, valid will that protects your family and property after your death. The book provides step-by-step instructions and all the necessary forms to make a will that suits your needs. It covers estate planning basics, such as naming beneficiaries, choosing a guardian for young children, setting up trusts, and more. The updated 9th edition includes the latest changes in federal estate tax law and a new appendix that lists state probate exceptions. Overall, it is a great resource for laypeople who want to write a valid will quickly and safely without a lawyer.

Where I Buried The Bodies and Other Things You Need To Know When I'm Gone: Peace of mind end of life planner and organizer with all the important ... your personal, family, and business affairs

If you're looking for a comprehensive guide to organizing your end-of-life affairs, "Where I Buried The Bodies and Other Things You Need To Know When I'm Gone" is the book for you. Cheryl Johnson's journal is designed to help you record and organize all your personal and professional information in one place, making it easier for your loved ones to handle your affairs after you pass. With sections for financial information, property and real estate, important contacts, and more, this journal is a great resource for adults of all ages. Overall, this book is a valuable tool for anyone looking to get their affairs in order.

Frequently Asked Questions (FAQs)

1. What you should not include in your will?

Here are some items that you should never put in your Will:. Business interests.Personal wishes and desires.Coverage for a beneficiary with special needs.Anything you don't want going through probate.Certain types of property.

2. Are estate planning documents necessary before death?

Estate planning is not only for the wealthy—everybody can benefit from ensuring their assets and finances are properly taken care of after their death. Without a will, a probate court could lead to an unintended distribution of assets. Estate planning is also useful if you become incapacitated.

3. Do you list your assets in your will?

By including specific assets in a Will and naming beneficiaries (the people who will inherit those assets) you can make sure that your property is passed along exactly how you want, and you can help your family avoid disagreements over the distribution of your assets.

During our estate planning law for wills books research, we found 1,200+ estate planning law for wills books products and shortlisted 10 quality products. We collected and analyzed 10,590 customer reviews through our big data system to write the estate planning laws for wills books list. We found that most customers choose estate planning laws for wills books with an average price of $15.69.

Wilson Cook is a talented writer who has an MFA in creative writing from Williams College and has published more than 50 books acquired by hundreds of thousands of people from various countries by now. He is an inveterate reading lover as he has read a vast amount of books since childhood.